Assessing News and Notes: November 2019

![]()

Wakefield’s annual classification hearing took place at the October 15, 2018 Town Council meeting. This public hearing is a requirement of Massachusetts General Law and necessary in order to establish tax rates and send tax bills in a timely manner. Classification was adopted by the councilors and subsequently approved by the Massachusetts Department of Revenue.

Our fiscal year (FY) 2019 tax rates will be:

- $12.83 per thousand for residential properties

- $25.15 per thousand for commercial / industrial / personal (CIP) properties

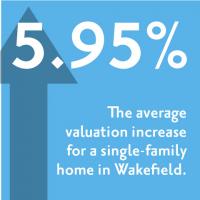

How the rate was determined. Our department engaged in a state-mandated interim revaluation of town properties for FY 2019. We used sales from calendar year 2017 as a basis for most residential valuations and 2016-2017 data for other classes where there were too few sales to analyze. Using these figures, the average single family home valuation increased from $498,500 to $528,200, or about 5.95 percent. Commercial and industrial properties remained steady for the same period.

Our department engaged in a state-mandated interim revaluation of town properties for FY 2019. We used sales from calendar year 2017 as a basis for most residential valuations and 2016-2017 data for other classes where there were too few sales to analyze. Using these figures, the average single family home valuation increased from $498,500 to $528,200, or about 5.95 percent. Commercial and industrial properties remained steady for the same period.

Data obtained from MLS Property Information Network, Inc. indicated that the average sale price for a single family home in Wakefield increased from $513,956 to $534,976 from 2016 to 2017 while days on market decreased from 48 to 34 days.

For the past several years, the Town Council requested an excess levy capacity that corresponds to a roughly 2 percent tax levy increase rather than the usual 2.5 percent to mitigate some of the tax impact to residents. This year, the council requested an excess levy capacity of almost $573,677, a 2 percent tax levy increase. This action saves $0.10 on the residential rate, an average savings of $53 for residential taxpayers, and $0.20 on the CIP rate, an average of $262 savings for commercial properties. The councilors chose the maximum allowable shift factor, thereby affording residential taxpayers the lowest possible share of the tax burden allowed under state law.

Fiscal Year 2019 also represents the fifth year of the full debt exclusion for the new Galvin Middle School. This added $2,408,343 to our total tax levy and conforms to the restrictions of Proposition 2 ½. It adds $0.42 to the residential tax rate, or $222 on the average single family tax bill, and $0.83 to the CIP tax rate, or $1,089 to commercial property bills.

What does this mean for you?

What does this mean for you?

For an average single family home with a value of $528,200, the corresponding tax bill is expected to increase approximately $322 to $6,777, or 4.9 percent. Since 2006, the average single family tax bill increase has been 4.46 percent.

The average commercial tax bill is expected to average $33,002.

Property owners must be mindful that the assessments on their tax bills, due February 2019, are reflective of 2017 real estate market activity. Sales activity from 2018 will be used for assessments made next year.

Browse through this site to view property assessment data, value and tax FAQs, and other tools of interest to property owners.

Exemption news

Statutory exemption recipients still have time to file paperwork at Town Hall. If you are unsure if you are eligible for a senior 65+, disabled veterans, surviving spouse, blind, or tax deferral exemption, please give us a call at 781-246-6380. All exemptions are subject to various qualifying criteria.